Is there anyone who doesn’t want to become rich? Would you like to be a millionaire? They say money can’t buy happiness. However, having financial security can certainly change your life for the better and make it easier.

In challenging times of economic uncertainty, we all want working tips on how to build wealth. In this article, we are going to share with you some pieces of advice on how to get wealthy in Canada.

Who Wants to Be a Millionaire?

We all dream of being financially independent. Nobody wants to have a mountain of debt or live paycheck to paycheck. Real life is totally different, though. We have to make different financial decisions once in a while and often take risks.

You can’t live your life without taking any risks. Whether it’s a mortgage or a student loan, or a small loan from your friend, you take certain risks and take responsibility for your action and the debt repayment.

What is the formula for financial success? If there was such a formula, life would definitely be much easier. You should stay away from scammers who claim that you can get rich in a day.

This is a myth that is far from being true. There will always be some people who want to find the easiest path but they will only waste their time in the long run.

How to Be Rich in Canada

It’s necessary to admit that Canadians are lucky enough to have a relatively strong economy with an abundance of financial resources and a solid social welfare system. Thus, people from other countries consider all Canadians really rich.

Yes, our standard of living is higher compared to other places around the world. On the other hand, if we look at our citizens, do all of them are millionaires in reality?

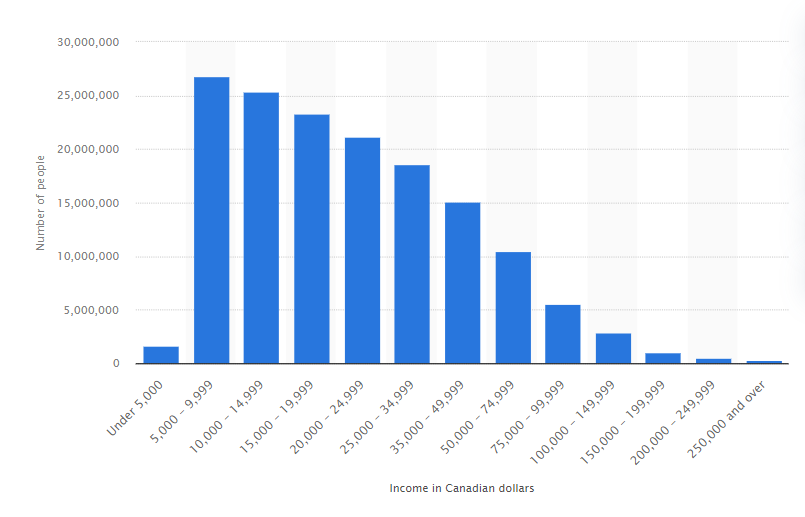

Canadian statistics show that one needs an annual income of over $271,300 to rank in the top 1% of Canadian income earners. Over 750,000 citizens of Canada reported having a net worth of over 1 million dollars in 2019.

This number may not be correct due to the fact that home equity adds to the net worth. What person can be called wealthy?

If a person can live without the need to actively work and has a chance to live off of their assets’ income, he or she may be called wealthy.

There is nothing better than feeling financially secure and independent, especially in modern life where so many individuals struggle to make the ends meet or live beyond the poverty line.

Top Ways to Become Rich in Canada

There is no one-size-fits-all answer or method to build wealth. Here are some steps you can make to become more financially stable and be rich.

1. Build Several Income Streams

You won’t be able to become a millionaire if you just have a regular 9-to-5 job in the office. If you dream big, you should also think about building multiple income streams.

Only highly paid specialists like a lawyer or a doctor may have enough to set aside and build a safety net for the future.

If you don’t want to spend decades trying to save some funds, you should look for alternative ways to increase your monthly income and diversify it.

It may be a side hustle or a real estate investing that will support you and offer additional streams of regular profit.

Do you need more examples of what you may try as a prospective income stream apart from your full-time position? Here are some ideas:

- Rental property income

- Second job

- Rent an Airbnb

- Affiliate marketing

- Freelancing (graphic design, writing, etc.)

- Uber driver

- Royalty income (songwriting, book sales)

- Blogging

2. Invest in Assets

Another useful tactic is to invest in different income-producing assets so that you boost your chances of getting a profit in the long run. What can these assets be? A rental property may fall into the real estate asset class.

Individual company stock is an equity investment. If you have multiple assets from different categories, you minimize risks. You may want to choose some options from this list of assets:

- Government and corporate bonds

- Commercial real estate

- Residential real estate

- Cryptocurrency

- Stock market

3. Lower Spending

It may sound less attractive but you should also cut your monthly expenses if you want to become wealthy. Think about ways to reduce your spending and categories you may skip or trim.

Do you keep track of your spending? If not, you should establish a monthly budget to check where your income goes. You may spend too much on eating out, clothes, or entertainment.

Can you get rid of your credit cards? Why don’t you start making lunch at home? Trimming your daily expenses can save you several hundred dollars a month which may be put into your savings account.

If you aren’t sure how to start, get a credit card statement or the history of your bank account for the last three months. You will see the real picture of how well you manage your personal finances and what types of expenses are non-essential at the moment.

The Bottom Line

Financial independence is what millions of people want to reach today. This is a worthwhile target and you should be self-organized and motivated to keep going until you reach it. Change your lifestyle and become more frugal.

Lower your monthly spending and create a budget to trim costs. Build multiple income streams and invest in assets to build wealth faster.

Don’t forget to get rid of any debt or loan payments you might have. Being financially independent means having no debt obligations and having enough funds set aside.

Having a side gig, investing, and having a budget will help you reach stability and organize your life. However, you should also remember not just to make money but also to invest it so that it actually works for you and helps you build wealth.