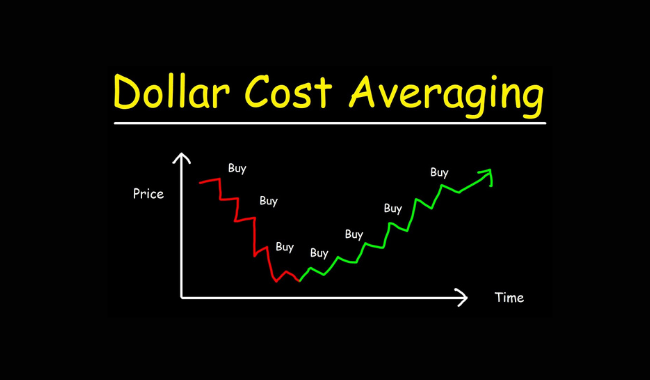

Dollar-cost averaging (DCA) stands as a long-term investment strategy where fixed amounts of money are invested in a particular asset at regular intervals, regardless of its price.

Instead of investing a lump sum at once, the investor spreads purchases across time. The main goal is to reduce the effects of market volatility and avoid the risk of making poorly timed investments.

Understanding the Core Concept

At its foundation, dollar-cost averaging involves purchasing more units of an asset when prices are low and fewer units when prices are high. Over time, this reduces the average cost per unit. By automating purchases, the strategy eliminates emotional reactions tied to market swings, often seen in speculative investing.

The simplicity of DCA lies in its mechanics. Suppose a person invests $500 every month into a mutual fund. In a bullish market, fewer shares are bought.

In a bearish phase, the same $500 purchases more shares. Over years, the average price paid per share tends to stabilize and may be lower than the average market price.

Purpose and Advantages

The primary advantage of dollar-cost averaging lies in risk mitigation. Timing the market is difficult, even for seasoned professionals. Volatility can derail even well-researched strategies. DCA limits the potential damage caused by entering the market at an unfavorable time.

DCA encourages consistency. Investors remain committed to a schedule, which supports financial discipline. It also minimizes regret. When markets drop after a lump-sum investment, investors often second-guess their decisions. With DCA, the emotional strain is lighter.

Cost efficiency forms another key benefit. Buying more units when prices fall and fewer when they rise naturally improves average acquisition cost. Over a long horizon, this often enhances overall returns, especially in volatile markets.

Common Use Cases

Dollar-cost averaging often supports retirement planning. Monthly contributions into 401(k) or IRA accounts exemplify its application. Many employer-sponsored retirement accounts use this method by default.

DCA fits well for those investing in mutual funds, index funds, and ETFs. Assets with fluctuating values benefit the most. In contrast, stable instruments with fixed interest or prices offer limited benefit through DCA.

Cryptocurrency investments have also seen adoption of this strategy. Given the extreme volatility in digital assets, DCA allows cautious entry without exposing capital to sharp declines from a single entry point.

Key Metrics to Track

Tracking average cost per unit helps measure the effectiveness of the strategy. If market values trend upwards over time, the average cost will typically remain below the final price, leading to gains.

Another metric is internal rate of return (IRR). Comparing IRR of a DCA strategy to a lump-sum strategy over similar time periods can reveal whether the gradual investment route yields competitive returns.

Monitoring frequency and total investment amount ensures consistency. DCA works best when maintained through both market highs and lows. Gaps in the schedule reduce its effectiveness.

How to Implement Dollar-Cost Averaging

Start by selecting the asset or assets to invest in. Index funds like the S&P 500 ETF are common choices due to their diversification and long-term growth potential. Next, choose an investment amount and a schedule. Monthly or biweekly contributions are most common.

Set up automatic investments through brokerage accounts or financial platforms. Automating removes the need for manual action and reduces the temptation to time the market.

Evaluate the portfolio periodically. Adjust contribution levels if financial circumstances change. However, avoid modifying the frequency or amount based on short-term market movements.

Stay consistent, even in downturns. Some of the most valuable contributions are made during bear markets when prices are depressed.

When Dollar-Cost Averaging Works Best

DCA performs best in volatile or downward-trending markets that eventually recover. Buying during market dips lowers the average cost, and when the market rebounds, profits emerge more easily.

Long-term goals amplify the impact of DCA. Retirement, children’s education funds, or long-range wealth-building targets benefit from compounding returns, where time multiplies small contributions.

DCA also supports inexperienced investors. By removing decision-making from each purchase, it creates a passive pathway to enter investing.

When DCA Might Not Be Ideal

In consistently rising markets, lump-sum investing often outperforms DCA. Entering early captures gains from the start, while gradual entry buys assets at increasingly higher prices.

For investors with significant knowledge or those able to tolerate high risk, tactical entries might yield better outcomes. Active management sometimes outpaces passive methods like DCA.

DCA also loses relevance for assets with minimal price fluctuation. Stable-value funds or CDs provide no advantage for staged investing.

Dollar-Cost Averaging vs Lump Sum Investing

Lump sum investing places all capital into the market at once. It maximizes exposure to market growth, especially in bull cycles. Historical data shows that lump-sum investments outperform DCA in most scenarios, assuming the market trends upward.

However, the lump sum approach carries emotional burden. A steep market correction soon after a large investment often triggers panic selling. DCA avoids this by entering gradually, smoothing the impact of short-term swings.

Dollar-cost averaging can be seen as a psychological buffer. It provides peace of mind and lowers regret. On the other hand, lump-sum investing remains statistically superior in strong, upward markets.

The choice depends on the investor’s mindset, goals, and risk profile.

Examples in Practice

Suppose $600 is invested over three months into a fund. In month one, the price per share is $30, resulting in 20 units. Month two, the price drops to $20, so 30 units are bought. In the final month, the price rises to $40, buying 15 units. In total, 65 units were acquired for $1800.

The average price per share paid is $27.69, while the market average is $30. Even if the market stayed flat, the strategy would still reduce the cost basis. This difference becomes crucial in volatile markets.

Another scenario involves investing in Bitcoin. Given high volatility, investing $200 weekly reduces exposure to sudden crashes. Some weeks result in more coin, others less. Over time, the average cost balances, especially if held for years.

Risks and Misconceptions

Dollar-cost averaging does not eliminate risk. It softens volatility but does not guarantee profit. Prolonged bear markets may still result in losses despite regular purchases.

A common misconception is that DCA always outperforms lump-sum investing. That is not true in bull markets. The benefits of DCA arise primarily from emotional control, not from maximizing returns.

Another error is halting contributions during downturns. That negates the core strength of DCA—buying more during dips.

Automation Tools for DCA

Brokerage platforms often provide recurring investment features. Vanguard, Fidelity, Charles Schwab, and online platforms like Robinhood or SoFi support scheduled buys.

Fintech apps like Acorns and Stash design portfolios around small, regular contributions. These tools simplify the process, especially for beginners.

Spreadsheets or tracking software can also help monitor progress. Recording units bought, prices paid, and total contributions provides a clear view of performance.

Behavioral Impact and Emotional Benefits

Psychological studies suggest that emotional investing leads to underperformance. Greed in bull runs and fear in market dips cause investors to buy high and sell low.

DCA counters emotional investing by introducing routine. Investors no longer rely on guesswork. Fear of market timing disappears. Instead, decisions shift from “when” to “how much” and “how often.”

This behavioral shift often results in better long-term engagement. Investors stay invested longer, leading to stronger compounded growth.

Tax Considerations

Each purchase under DCA creates a separate tax lot. When selling, identifying which units are being sold can affect tax liability. Methods like FIFO (first-in, first-out) or specific identification can be used.

In taxable accounts, capital gains taxes apply on profitable sales. Holding investments for over one year qualifies for lower long-term capital gains rates.

Automated investing does not exempt investors from tax obligations. Keeping records remains crucial, especially for frequent or high-volume contributions.

Final Thoughts

Dollar-cost averaging remains a widely adopted investment strategy. Its strength lies in consistency, emotional detachment, and long-term application. While it may not always outperform lump-sum investing in raw numbers, it often wins in discipline.

Used properly, DCA enables structured wealth accumulation. It suits investors aiming to build positions gradually without timing market peaks or troughs. In volatile or uncertain markets, it often becomes the preferred strategy for minimizing regret and maximizing peace of mind.