New, innovative technologies are being used across the finance sector to revolutionize how finance companies work. FinTech developments are vital for improving customer experience and enabling more efficient working practices while embracing a new digital era. This is key to staying ahead of the field.

Technology is modernizing how everyone approaches finance, from simple banking apps to the complex artificial intelligence processes used for analyzing foreign exchange. Face-to-face appointments have mostly been made redundant as digital apps replace slow, time-consuming processes.

1. Security

As technology has advanced, so has cybercrime, making it more important than ever for the financial market to ensure the most up-to-date security technology is used to protect customers. Online security is committed to staying ahead of ever-developing cybercrime tactics.

Ransomware payments are becoming increasingly common. They use malicious software to access a user’s files and block their access.

The user then has to pay a ransom to get the decryption key, enabling them to re-access their information. However, ransomware is becoming increasingly clever at evading detection by security systems.

Businesses have been increasing their investment in biometric solutions to provide the highest security levels possible to protect customers.

Previously, this has involved using fingerprint identification, but a public health concern has driven the development of contactless biometric identification that will become increasingly used in the future.

2. Automation

Automation within the finance sector has been revolutionary for improving many clerical processes.

By using robotic process automation and artificial intelligence, time efficiency has been maximized, and employee workload has decreased. This allows more time for workers to concentrate on more complex projects.

Areas where automation can be implemented include:

- Production of invoices

- Payroll

- Financial analysis

- Producing financial reports

- Paying invoices

- Completing tax requirements

There are various methods used to automate these tasks. For example, chatbots are becoming increasingly popular. They enable customers to have conversations with a virtual assistant, eliminating the need for customers to wait in queues for in-person appointments.

They are easy for customers to access via online platforms and allow personalized information to be provided to the customer.

3. Robotic Process Automation

Automation starts with basic robotic processing. This is used to replicate repetitive, manual tasks, so they become digitized and run entirely by computer software.

Previously these tedious tasks would have been completed by employees, so this process is essential for saving valuable time. Robotic process automation also has the advantage of being error-free, helping to improve a company’s performance.

4. Artificial Intelligence

Artificial intelligence is an exciting but complex method for automating a process. The use of intelligent thinking permits software to make decisions based on the information that is being input.

Machine learning enables software to analyze data using algorithms and to problem solve with impressive results. In the future, artificial intelligence will become increasingly used within finance for analyzing and forecasting.

5. Cryptocurrency

Over recent years, cryptocurrencies such as Bitcoin have rapidly increased in popularity. Cryptocurrency has the advantage of being almost impossible to counterfeit, so some traders consider it a safer investment option. This decentralized currency also enables cheaper and faster transfers.

Cryptocurrency uses Blockchain technology for completing transactions and tracking assets, as it decreases human error and is cost-effective, providing a safe and efficient way to use virtual currencies.

Users also like the transparency of each transaction, with all details being freely accessible. While cryptocurrencies are still not commonly used within retail, they are becoming more mainstream in trading. This has resulted in a rapidly increased interest in cryptocurrencies for investing.

6. Mobile Applications

Mobile apps have been revolutionary in bringing finance into the digital age. They are quick for users to download and convenient for monitoring finances while out and about.

There are now apps available for a variety of uses, including:

- Personal finance

- Budgeting

- Investing

- Cryptocurrencies

- Banking

- Making payments

Apps allow customers to complete all their banking and finance needs using a mobile. They can be accessed 24 hours a day and are a simple way to track payments, open accounts, and monitor money.

Using finance apps saves vital time, so it is a convenient tool for all customers with busy schedules.

7. Mobile Payments

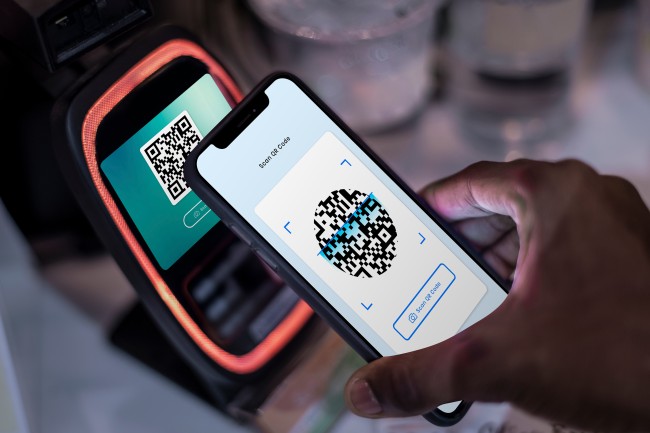

The use of mobile payments enables digital transactions to be carried out by only using a mobile phone. A digital mobile wallet is used to store bank details, and then payments are made using the mobile handset itself.

To accept mobile payments, businesses need a point of sale system. This enables the transaction to be processed wirelessly using near-field communication.

The tech giants Apple and Google were the first companies to start using mobile payments, with the launch of Apple pay and Google pay.

Since their release, contactless mobile payments have become increasingly popular, with many businesses now moving to this style of payment.

8. Fintech Developments

Over recent years technology has advanced rapidly and has been improving the digital services available within all areas of finance. This has been a vital step for maximizing efficiency and accuracy and is at the forefront of ensuring the best possible customer experience.